In a world racing toward net-zero emissions goals, carbon credit trading has become a vital mechanism for incentivizing emissions reductions. Yet traditional systems often struggle with opacity, double-counting, and concerns with trust that undermine market credibility. Blockchain technology—an immutable, decentralized digital ledger—offers a promising solution by enabling secure, transparent recording of every carbon credit from issuance to retirement. Its cryptographic timestamping and distributed consensus ensure that credits can be traced and verified without reliance on a single central authority, reducing fraud and boosting confidence among buyers and sellers globally.

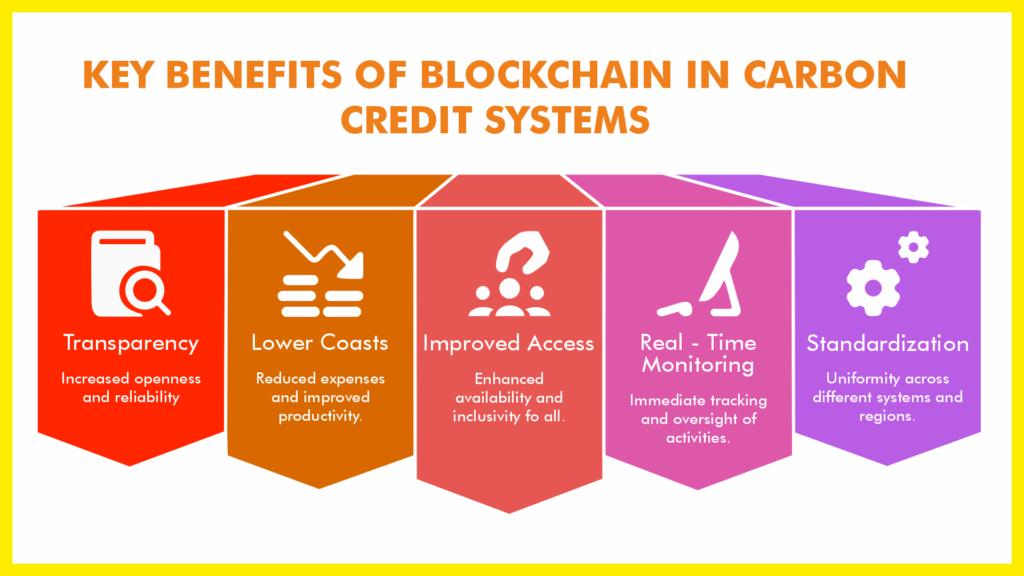

Across the globe, innovators are tokenizing carbon credits on blockchain platforms to make them fully auditable and tradable as digital assets. Smart contracts can automate compliance checks and transactions, cut administrative costs, and speed up settlements while maintaining a trusted audit trail. Decentralized registries also help bridge fragmented national systems so that a credit issued in one jurisdiction remains unique and verifiable when traded internationally—an essential feature as cross-border carbon markets grow rapidly.

However, blockchain is not a silver bullet. Its effectiveness depends on integration with robust measurement, reporting and verification (MRV) systems, credible certification standards, and legal recognition across jurisdictions. Energy use and scalability of some blockchain networks are ongoing concerns, and regulatory frameworks must evolve to support widespread adoption without compromising environmental integrity or excluding vulnerable project developers in emerging economies worldwide today.

In the Indian context, the nascent carbon market established under the Carbon Credit Trading Scheme (CCTS) and related frameworks is gaining traction, with fintech and blockchain startups exploring tokenized credits to enhance transparency and reduce fraud. Blockchain’s ability to uniquely verify and track credits could support India’s expanding carbon marketplace, potentially strengthen investor trust and enabling small enterprises and farmers to participate more effectively.

Overall, when paired with strong standards of digital governance and interoperable systems, blockchain can make carbon credit trading more transparent, efficient and trustworthy. This is crucial for mobilizing climate finance and ensuring that carbon markets effectively contribute to real emissions reductions globally.

SOURCES: