In 2024, the global carbon credit trading landscape experienced notable changes, particularly with the operationalization of Article 6.4 of the Paris Agreement during COP29 in Baku. This mechanism aims to create a centralized market under UN supervision where countries and private actors can trade emission reduction credits generated through verified mitigation projects. It is seen as a key tool to achieve global net-zero targets by allowing countries with lower mitigation costs to sell excess reductions to others.

However, experts caution that issues around additionality, double counting, and low-quality credits could undermine environmental integrity and public trust in the system. Countries like Singapore have made strategic investments to establish themselves as carbon trading hubs. In 2024, Singapore introduced new transparency measures and expanded its registry system to ensure robust emissions data and verification standards.

The city-state’s efforts are helping build a credible market in Asia by supporting cross-border carbon credit trade. In contrast, Canada faced a political setback when public resistance led to the rollback of its carbon pricing scheme despite its environmental merits. This serves as a reminder that public engagement and clarity in policy design are crucial for long-term viability.

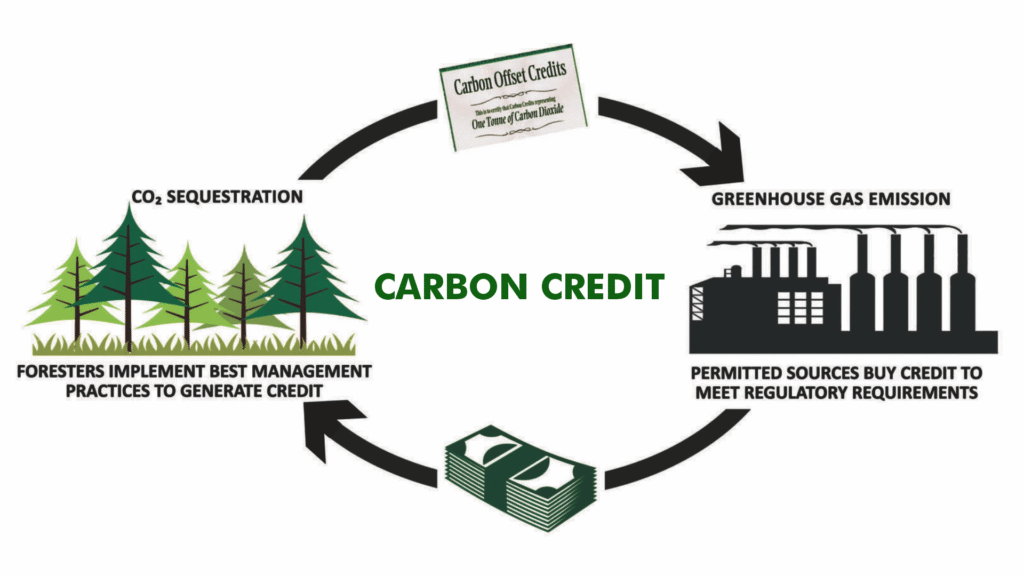

At the same time, the voluntary carbon market is growing, with multinational corporations increasingly investing in nature-based offsets.

The Integrity Council for the Voluntary Carbon Market (ICVCM) has introduced Core Carbon Principles in 2024 to improve the quality and credibility of offsets, reflecting the growing global demand for transparent and standardized carbon credit systems. India has also taken a significant step by notifying the Carbon Credit Trading Scheme (CCTS) in July 2024. This scheme lays the foundation for a compliant carbon market targeting emissions-intensive sectors such as power and manufacturing. The Bureau of Energy Efficiency (BEE) has been designated as the administering authority to issue and monitor carbon credit certificates.

In parallel, a voluntary market framework is being developed for non-mandated entities. The current design covers only about 30% of India’s total emissions, highlighting the need for broader sectoral inclusion and stricter verification processes. Global and national efforts alike indicate that while carbon credit trading holds promise, rigorous standards, robust infrastructure, and adaptive governance will ultimately determine its long-term effectiveness and global credibility.